(Published in CBBC Focus on 9th October 2023)

At the 75th General Assembly of the UN, China announced that it was committing to reaching peak carbon emissions by 2030 and carbon neutrality by 2060. President Xi Jinping called for all countries to commit to innovative green development, stating that exploiting the environment with little concern for conservation was no longer an option.

Beijing is still thought of outside of China as one of the most polluted places on earth, but PM2.5 emissions – the main issue for the city – are a third of what they were a decade ago, with the falling trend continuing. The skies have turned blue, and we can, in part, attribute this improvement to China’s huge investment in green energy, a field in which the country has rapidly become a world leader. This has resulted in it becoming effectively essential to global green energy supply chains.

No sector highlights China’s centrality to global renewable energy more than the solar energy industry. China currently supplies around 90% of the world’s photovoltaic modules, giving the country tremendous leverage over future energy markets globally.

If you need tangible evidence of China’s investment in renewable energy, look no further than Golmud Solar Park in Qinghai province. With a capacity of 2.8 gigawatts, it is the largest solar power plant in the world. It is, however, not the only mega solar power plant in the country. The Tenger Desert Solar Park in Ningxia province has a capacity of 1.5 gigawatts and spreads across 43 square kilometres.

China is the world’s largest exporter of renewable energy infrastructure, responsible for 90% of the global photovoltaic cell supply and 50% of wind turbines. This means that China is absolutely essential to the global renewable energy market. With increasing pressure from international organisations such as the IPCC to take the climate crisis more seriously in at least the short to mid-term, China is effectively the green energy transition factory until other countries grow their renewable energy manufacturing sectors.

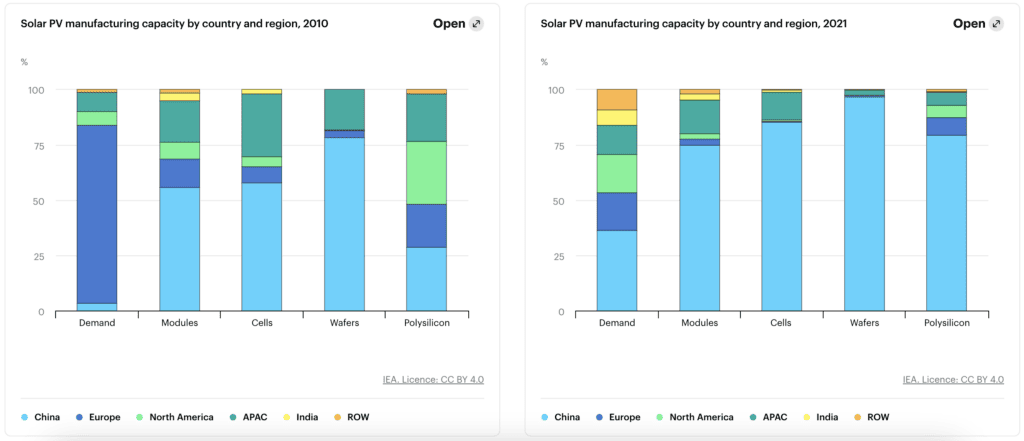

The pace at which China has become the key player in global PV supply is as startling as its current scale. A report from the International Energy Agency (IEA) shows how, between 2010 and 2021, China’s share of global demand skyrocketed from 3.5% to 36%. Meanwhile, former spearhead Europe toppled from representing 80.4% of global demand to a mere 16.8%. Over the same period, the share of every core element in the supply chain has become concentrated in China.

Source – IEA

This pole position was achieved through a number of factors, the first of which is huge investment. China was responsible for nearly half of global clean energy investment in 2022, investing US$ 546 billion. The EU, as the second largest spender on clean energy, invested US$ 180 billion, less than a third of China’s total.

Then comes economies of scale. China has fulfilled a role as ‘the world’s factory’ for decades now and has formidable manufacturing expertise. It also has the space to build infrastructure at a scale unfeasible for most countries, as proven by its PV mega projects.

China’s geographical size and characteristics mean it has an abundance of the raw materials essential to PV components. The charts above from the IEA show, for example, how China has increased its production of polysilicon to over three quarters of the global supply. Data from Statista show that 98% of Europe’s rare earth imports (which it does not produce itself) originated from China in 2021.

China’s green transition and the UK

China may be ahead in zero-carbon technologies, but for the UK, there is an opportunity for collaboration. Thankfully, the potential and will are high, with each country offering its own expertise and sharing a common goal in leading the pursuit of carbon neutrality.

The urgency of the green transition adds to competition in both an economic and political sense, and China sees opportunity in this. Bob Ward, policy and communications director at the LSE Grantham Research Institute, told FOCUS: “China recognises the green transition as a race. The growing market for zero-carbon technologies and materials is a massive new economic opportunity. China has recognised this and is moving ahead more quickly than many of its competitors, including Europe and the US.”

On a global level, competition with China could play a key role in driving down the cost of the transition. “Competition can help to bring costs down further. Some people have argued that if China drops the costs so dramatically, it effectively puts everyone else out of business,” Ward added. “We have seen in the past companies seeking to develop monopolies – they put their competitors out of business and then control the costs and can put up prices. The experience with Solar PV is that China didn’t do that. They are simply aiming to beat everyone and become the world’s supplier.”

Although progress may have slowed, partnerships between the UK and China in green energy go back a decade. In 2013, the Conservative/Liberal Democrat coalition government signed an MoU for cooperation in offshore wind projects. Offshore wind is very much a success story of China-UK energy cooperation. The UK is considered a world leader in offshore energy, but behind the scenes is Chinese investment and energy storage projects. The largest lithium battery storage plant in Europe was set up in the UK in 2021 using technology from the Chinese firm Sungrow.

One of Sungrow’s most recent UK projects sees the transformation of a decommissioned coal energy plant into a green battery storage unit in Ferrybridge, West Yorkshire. It is expected to be able to supply the national grid with 300MWh of capacity upon completion in 2024. The project is thus more than a contribution to the UK grid – it has a symbolic value in tangibly transforming a site of former fossil fuel energy into a green one.

The UK is also a world leader in green finance, with London ranking as the top green financial centre globally in the 2023 Green Finance Index. This offers clear synergy with China’s capital-intensive manufacturing expertise and a potentially global reach of positive impact.

In a recent report, Baillie Gifford, a CBBC member company, long-term investor in China and ESG expert, states that despite the rapid growth in ESG investing and infrastructure to support it, there are still significant knowledge gaps to making sound ESG decisions in the China market. Among the points of their overall ESG due diligence checklist are specific sustainability questions: Does a company disclose carbon emissions and set a carbon reduction target? Is the company compliant with the UN Global Compact?

Baillie Gifford’s China Growth Trust 2023 report highlights the difference that targeted ESG finance can have on decarbonising investment. On a measure of weighted average carbon intensity comparing their China portfolio to an average index, the portfolio had an 85% lower carbon intensity. The portfolio includes multiple firms engaged in renewable energy supply chains, from component suppliers to EV battery producers.

The climate crisis is a global issue, demanding global cooperation. With green energy supply chains very much focused in China, the UK will need to collaborate if it is to meet its own green targets. As the London Environment strategy targets a carbon-neutral capital by 2050, much inspiration can be drawn from the newly blue skies of Beijing.